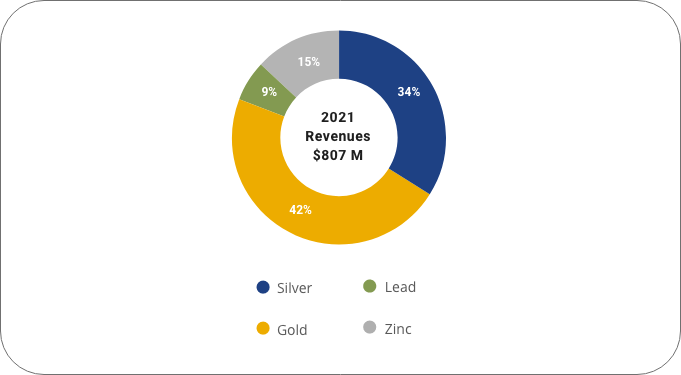

Hecla Mining Company:

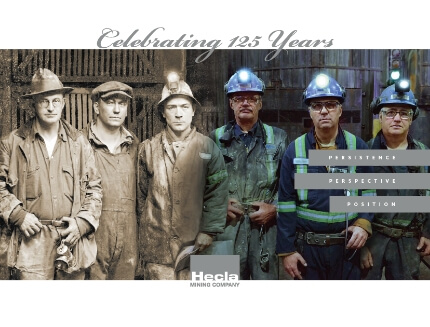

A Legacy of Success

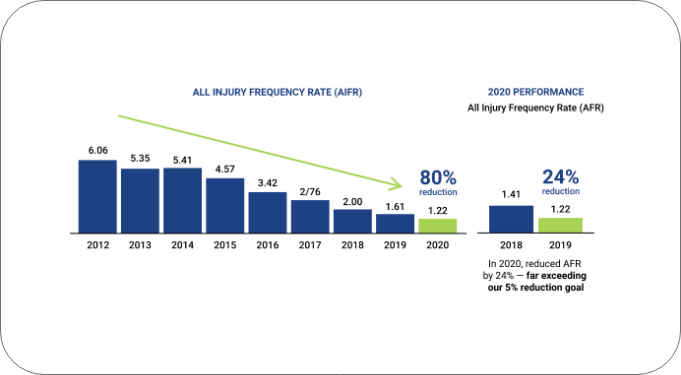

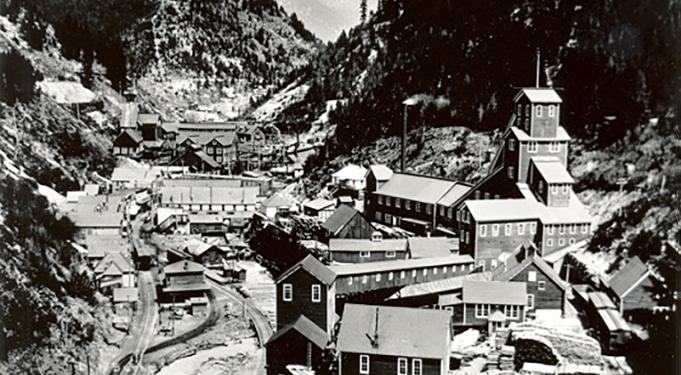

Established in 1891, Hecla sits in the heart of one of the largest silver-producing districts in the world. Becoming the largest primary silver producer in the United States is no small feat. Hecla has applied grit and determination, exercised discipline in times of prosperity and adversity, and has never compromised on our commitments to safety and responsibility.