Greens Creek

Admiralty Island, Alaska

As the largest silver mine in the United States, the team at Hecla Greens Creek has demonstrated that its safety record and environmental stewardship are among the best in the world.

As the largest silver mine in the United States, the team at Hecla Greens Creek has demonstrated that its safety record and environmental stewardship are among the best in the world.

Mine Type

Ownership

Silver

Gold

Lead

Zinc

***All metals reflect 2023 production

At our Greens Creek mine, we established the Greens Creek Community Advisory Committee (CAG), a collaborative effort with our local stakeholders to ensure that input from the community is considered in the environmental and social aspects of the mine’s planning and operations. The group is comprised of representatives from stakeholder constituencies including the Alaska Native community, municipal government, private sector, educational and academic institutions, local environmental community, and humanitarian/charitable organizations. In 2022, the group included an Angoon community member, the President-CEO of United Way of Southeast Alaska, the Mayor of Juneau, an energy educator, the former head of the Greater Juneau Chamber of Commerce, and the Chancellor of the University of Alaska Southeast (UAS).

The Greens Creek Mine has been a proud member of the Juneau community for 35 years. Today, we are the region’s largest private employer and its largest taxpayer, providing approximately 510 direct jobs and just over 450 indirect jobs statewide.

The salaries and taxes we pay contribute to making Juneau a better place to live – from enabling our employees to own good homes, to helping our local government provide essential services. These expenditures radiate throughout the community – from employees taking their families to locally owned restaurants to supporting seemingly unrelated jobs within local governments and businesses.

in 2022, the mine made a direct economic impact in local communities of more than $219 million, including approximately $76.8 million in wages, $29 million in taxes and fees, and $112 million in purchases from vendors. Greens Creek is also the largest provider of student aid at the University of Alaska Southeast (UAS) contributing more than $1.8 million dollars since 2011.

Learn more about our economic impact on the Juneau community.

In addition, the men and women of Hecla Greens Creek are empowered to leverage the resources of our company to benefit the community – from making charitable contributions to local schools and nonprofit organizations, to rallying participation in volunteerism.

We annually support about 60 local and youth groups, art and education programs. We also proactively provide programs, marketing and information to help guide local residents into great careers at Hecla Greens Creek. We call that “Miner Strong” – and it’s something Hecla does at all its operations.

In 2021, the Alaska Chamber named the Greens Creek Mine winner of the Rita Sholton Large Business of the Year award, which pays tribute to businesses that exemplify leadership, ethics, and organization.

“Since 2011 Greens Creek has provided scholarship funding to over 350 Alaska residents to help gain the skills necessary to be successful in the mining industry. With over $500,000 going directly to student aid, Hecla Greens Creek is UAS’ largest sponsor of students.” - Chancellor Karen Carey, University of Alaska Southeast.

Safety is all about people. From engineering to behavior on the job, people are responsible for designing our mining process and safety protocols, and people are responsible for performing our work in a manner that best protects both personnel and the environment.

We believe in hiring the best people, providing them with the best training and the best supervisors, and empowering every one of our people to be personally responsible for safety – even if that means stopping a job or speaking up to a supervisor. At Hecla Greens Creek, we’re proud of our environmental and human safety record – and we work very hard to make safety our number-one priority.

Part of being Miner Strong means working hard while also protecting our teammates and environment.

Each Hecla employee and contractor is responsible for incorporating this policy into their daily planning and work activities to achieve this commitment. Here’s a video on Hecla’s commitment to safety

Under our culture of safety, we are always seeking ways to operate more safely, more efficiently and more effectively. This includes everyone from our senior engineers to our newest employee. We encourage everyone employed at Hecla Greens Creek to take responsibility for his or her own actions. Our employees actively think about how to do their jobs better, make suggestions to supervisors, and speak up when necessary. We encourage action any time a coworker is acting in a manner that is unsafe, disrespectful or abusive to anyone at our mine. We are a team, and a team looks out for each other.

Energy conservation is not just good for our environment, it’s good business. At Greens Creek, 88% of our electricity is sourced from the grid, of which 100% is renewable hydropower. In Alaska, Hecla purchases hydroelectricity from the Juneau-area utility company, Alaska Electric Light and Power (AEL&P) to power the Greens Creek mine. As a result, we thus avoided the use of over 8 million gallons of fuel. Our hydropower purchases also result in a lower electricity cost to Juneau residents and businesses. Affordable electricity is becoming more important as Juneau increases its electric vehicle use – the city now ranks second in the rate of EV ownership in the U.S. – and electrically powered infrastructure. As of July 2022, Greens Creek had benefited customers in the community by over $80 million since 2009.

Hecla Greens Creek Mine was an early adopter of the dry-stack method of tailings management. This method, while not applicable to all situations, minimizes the tailings surface footprint, reduces the amount of water retained in the tailings and lessens the consequences of any potential failure. This method also allows the opportunity for concurrent reclamation that further enhances the site’s stability.

To read more about dry-stack tailings, click here.

To review the 2013 Final Environmental Impact Statement and Record of Decision for the Greens Creek Mine tailings disposal facility expansion, please go here.

Hecla Greens Creek strives to reduce waste output on all fronts. We continuously explore the environmentally responsible use of resources, products and materials. We have developed active programs for reuse, recycling and recovery of all non-mineral wastes. Mineral waste (rock from mining development and mill tailings) remains on site and is utilized as much as possible for backfill in our underground mine and construction in and around our operation. In 2022, approximately 41% of the tailings produced are used as backfill inside the mine.

Hecla Greens Creek is required to return the mine site to a natural state after mining operations have ceased years from now. This includes removing structures, regrading and seeding the land, protecting and monitoring the tailings-storage facility and monitoring water quality. Over time, native trees and plants should reclaim the area. Some material will be buried in on-site landfill trenches that will be covered with soil and reclaimed, as required by regulatory agencies.

To pay for this reclamation, we have posted a $69 million bond held by state and federal agencies. Regulators have determined that a $13.6 million trust fund is expected to cover ongoing water treatment. The state now holds a surety bond in that amount.

Click to read more about our reclamation plan and financial assurance with the U.S. Forest Service and State of Alaska.

Updated Expansion Plan

Greens Creek files plan to expand tailings disposal facility

Expected to extend mine’s operation

JUNEAU, AK – Hecla Greens Creek mine has filed an amendment to its General Plan of Operations to expand its Tailing Disposal Facility (TDF) by approximately 13.7 acres. The expansion is primarily inside the existing U.S. Forest Service lease area and should allow mine operations to continue past 2031, when the current facility is expected to be full.

“This amendment culminates years of careful planning to develop a plan that minimizes impacts on Admiralty Island National Monument and the fish-bearing sections of Tributary Creek,” said Greens Creek VP and General Manager Brian Erickson. “We believe our proposed plan maximizes disposal volume and minimizes new disturbance.”

The filing sets off a formal process under the National Environmental Policy Act (NEPA), which began with the October 9, 2020 publication of a notice of intent (NOI) in the Federal Register. The NOI describes the proposed scoping process, including meetings and how the public can get involved, along with consultations with tribes.

The permitting process is a rigorous, transparent and objective process that assesses a proposed project. The process involves federal, state, and local levels evaluating if a project meets the environmentally responsible standards to be approved. There are many important stages that must be completed. Here is where we are:

Supplemental Environmental Impact Statement (SEIS) to 2013 Record of Decision

USFS Project website: https://www.fs.usda.gov/project/?project=57306

October 2020—Virtual scoping meetings and public comment

November 2020—Scoping comments closed

February 2022—Draft SEIS published and public comment

April 2022—DSEIS public comments closed

December 2022—Draft record of decision and objection period

March 2023—Supplemental draft environmental impact statement (EIS) public comment period

May 8, 2023—EIS public comment period closes

June 15, 2023—Hecla annual Greens Creek Mine Annual Meeting

February 2024—Draft record of decision

March 2027—All other federal, state, local permits in hand

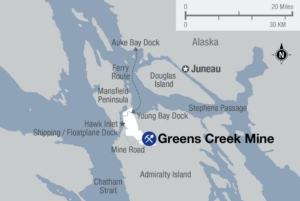

Virtually everything we do at Hecla Greens Creek is designed to care for and protect our very special part of Alaska. We are located on Admiralty Island about 18 miles southwest of Juneau and 40 miles north of Angoon.

Most of Admiralty Island is a federally protected wilderness area administered by the Tongass National Forest. More than 955,000 acres (3,860 km2) of it have been designated as a national monument. Greens Creek sits inside the national monument on the northwest end of the island, but outside the 936,649-acre Kootznoowoo Wilderness area.

We are the only mine congressionally designated to operate in a national monument, which means our safety and environmental record must be among the best in the world.

Environmental stewardship starts with safety, and safety is reliant on the quality, training, and dedication of our people. Hecla Greens Creek prioritizes finding the best people and arming them with thorough training and quality leadership. Our goal is to ensure Hecla employees always put safety first in everything they do every day. This is important for the safety of our mine, our environment and our employees, and it means we must maintain a dedication to both big-picture engineering and everyday worksite behaviors.

Hecla Greens Creek meets the very stringent state and federal standards for air and water quality. In addition, we continually work to devise ways to conserve water through efficient operations, engineering and training.

Our regulators monitor the mine through a robust program of sampling, quality analysis and audits. We discharge water into Hawk Inlet that is treated to the state’s stringent water quality standards. This discharge is regulated through state and federal permits, and ongoing monitoring finds it is well within the permitting thresholds.

Hecla uses and develops new technologies to maximize the safety of our people and our environment, to improve efficiency, to reduce our footprint, to limit our impact and to achieve our primary goal: responsible mining. This definitely is not your grandfather’s mine. Hecla consistently adopts technological advances in mining across the entire project – from communications to mining tools to personal safety gear.

We use applications such as high-speed wireless data transfer for underground monitoring, communication, data assessment and remote control. We are advancing tele-remote and battery-powered load, haul and dump equipment. This both reduces ventilation requirements and improves worker safety and lower emissions. Companywide, Hecla is using semi-autonomous technology during shifts to allow one operator to manage more than one piece of equipment at a time.

Our operations have upgraded underground ventilation, converted to biodiesel use, implemented cleaner engine technology and exhaust filtration, introduced enclosed and environmentally controlled cabs, and required protective equipment in high-exposure tasks and work areas.

Reducing lead exposure in the mill operations is also a priority. Annual blood tests measure employee exposure, which is minimized through personal hygiene training and the use of state-of-the-art respirators.

By mounting variable-frequency drives to our underground fans, we’re able to operate those fans at the right speeds at the right time, which in turn lowers our power consumption. Just one of these drives can save about $23,000 over the course of a single year. In addition, these technologies are lowering our environmental footprint – reducing greenhouse gas emissions, potentially reducing the volume of non-ore material brought to the surface, and improving water management at our mines.

What’s ahead? We’ve been doing a lot of exploring to expand the life of our operations. Hecla believes we can increase our silver, gold, lead and zinc reserves by 15 to 20% – while staying within our current operational area. We think our new development plan should yield 8% higher grades over the next four years without significantly increasing capital spend. Now that’s Miner Strong!

Email: [email protected]

Phone: (907) 789-8100

Mailing: Hecla Greens Creek

PO Box 32199

Juneau, AK 99803

The Greens Creek orebody contains silver, zinc, gold and lead, and lies within the Admiralty Island National Monument, the only mine in the U.S. that operates in an environmentally sensitive, protected area. The Greens Creek property includes 17 patented lode claims and one patented mill site claim, in addition to property leased from the U.S. Forest Service. Greens Creek also has title to mineral rights on approximately 7,500 acres of federal land adjacent to the properties. Total property package encompasses 23-square miles. The entire project is accessed by boat and served by 13 miles of road.

The Hecla Greens Creek mine holds current proven and probable silver reserves of 105,222 million ounces, 881 ounces of proven and probable gold reserves, as well as 250,580 tons of lead and 658,730 tons of zinc in proven and probable reserves.

Major facilities include the subsurface mine, an ore concentrating mill, a dry stacked tailings facility, a ship-loading facility, camp facilities and a ferry dock.

The mine began production in 1989 and today operates 24-hours a day, 365 days a year.

To learn more about Hecla, look here. To apply for current job openings at Greens Creek or any of our other operations, apply here.

The mine holds current proven and probable reserves of 105.2 million ounces for silver, 880 thousand ounces of gold, 250.6 tons of lead and 658.7 tons of zinc. Based on these reserves, Greens Creek has a 14-year mine life. Measured and Indicated resources contain 111.5 million ounces of silver, 239.2 thousand tons of lead and 643.9 thousand tons of zinc; Inferred resources contain 25.9 million ounces of silver, 55.9 thousand tons of lead, and 133.3 thousand tons of zinc.

| Tons(000) | Silver(oz/ton) | Gold(oz/ton) | Lead(%) | Zinc(%) | Silver(000 oz) | Gold(000 oz) | Lead(Tons) | Zinc(Tons) | |

|---|---|---|---|---|---|---|---|---|---|

|

9 |

11.3

|

0.08 |

3.5 |

8.4 |

100 |

1 |

310

|

740 | |

|

10,009

|

10.5 |

0.09 |

2.5 |

6.6 |

105,122

|

880 |

250,270

|

697,990

| |

|

10,018

|

10.5

|

0.09 |

2.5 |

6.6 |

105,222 |

881 |

250,580 |

658,730

| |

|

– |

– |

– |

– |

– |

– |

– |

– |

– | |

|

8,040 |

13.9 |

0.10 |

3.0 |

8.0 |

111,526 |

800 |

239,250 |

643,950

| |

|

8,040

|

13.9 |

0.10 |

3.0 |

8.0 |

111,526 |

800 |

239,250 |

643,950

| |

|

1,930

|

13.4 |

0.08 |

2.9 |

6.9 |

25,891 |

154

|

55,890 |

133,260 |

Totals may not represent the sum of parts due to rounding.

(2) Mineral reserves are based on $17/oz silver, $1600/oz gold, $0.90/lb lead, $1.15/lb zinc, unless otherwise stated. All Mineral Reserves are reported in-situ with estimates of mining dilution and mining loss.

(3) The reserve NSR cut-off values for Greens Creek are $230/ton for all zones except the Gallagher Zone at $235/ton; metallurgical recoveries (actual 2023): 80% for silver, 74% for gold, 82% for lead, and 89% for zinc.

Note: All estimates are in-situ except for the proven reserves at Greens Creek which are in surface stockpiles. Mineral resources are exclusive of reserves.

(12) Mineral resources for operating properties are based on $1,750/oz gold, $21/oz silver, $1.15/lb lead, $1.35/lb zinc and $3.00/lb copper, unless otherwise stated. Mineral resources for non-operating resource projects are based on $1,700/oz for gold, $21.00/oz for silver, $1.15/lb for lead, $1.35/lb for zinc and $3.00/lb for copper, unless otherwise stated.

(13) The resource NSR cut-off values for Greens Creek are $230/ton for all zones except the Gallagher Zone at $235/ton; metallurgical recoveries (actual 2023): 80% for silver, 74% for gold, 82% for lead, and 89% for zinc.

Reporting requirements in the United States for disclosure of mineral properties as of December 31, 2020 and earlier are governed by the SEC’s Securities Act Industry Guide 7, entitled “Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations” (Guide 7). Effective January 1, 2021, the SEC has issued new rules rescinding Guide 7. Mining companies are not required to comply with the new rules until the first fiscal year beginning on or after January 1, 2021. Thus, the Company will be required to comply with the new rules when filing its Form 10-K for the fiscal year ended December 31, 2021. The Company is also a “reporting issuer” under Canadian securities laws, which require estimates of mineral resources and reserves to be prepared in accordance with Canadian National Instrument 43-101 (NI 43-101). NI 43-101 requires all disclosure of estimates of potential mineral resources and reserves to be disclosed in accordance with its requirements. Such Canadian information is included herein to satisfy the Company’s “public disclosure” obligations under Regulation FD of the SEC and to provide U.S. holders with ready access to information publicly available in Canada.

Reporting requirements in the United States for disclosure of mineral properties under Guide 7 compared to the new SEC rules (Item 1300 of Regulation S-K under the Securities and Exchange Act of 1934) and the requirements in Canada under NI 43-101 standards are substantially different. This document contains a summary of certain estimates of the Company, not only of Proven and Probable reserves within the meaning of Guide 7, but also of mineral resource and mineral reserve estimates estimated in accordance with the new SEC rules and definitional standards of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in NI 43-101. Under Guide 7, the term “reserve” means that part of a mineral deposit that can be economically and legally extracted or produced at the time of the reserve determination. The term “economically”, as used in the definition of reserve, means that profitable extraction or production has been established or analytically demonstrated to be viable and justifiable under reasonable investment and market assumptions. The term “legally”, as used in the definition of reserve, does not imply that all permits needed for mining and processing have been obtained or that other legal issues have been completely resolved. However, for a reserve to exist, Hecla must have a justifiable expectation, based on applicable laws and regulations, that issuance of permits or resolution of legal issues necessary for mining and processing at a particular deposit will be accomplished in the ordinary course and in a timeframe consistent with Hecla’s current mine plans. The terms “Measured resources”, “Indicated resources,” and “Inferred resources” are mining terms as defined in accordance with the new SEC rules and NI 43-101. These terms are not defined under Guide 7 and prior to January 1, 2021, were not normally permitted to be used in reports and registration statements filed with the SEC in the United States, except where required to be disclosed by foreign law. The term “resource” does not equate to the term “reserve”. Under Guide 7, the material described herein as “Indicated resources” and “Measured resources” would be characterized as “mineralized material” and is permitted to be disclosed in tonnage and grade only, not ounces. The category of “inferred resources” is not recognized by Guide 7. Investors are cautioned not to assume that any part or all of the mineral deposits in such categories will ever be converted into Proven or Probable reserves. “Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of such a “resource” will ever be upgraded to a higher category or will ever be economically extracted. Investors are cautioned not to assume that all or any part of a “resource” exists or is economically or legally mineable. Investors are also especially cautioned that the mere fact that such resources may be referred to in ounces of silver and/or gold, rather than in tons of mineralization and grades of silver and/or gold estimated per ton, is not an indication that such material will ever result in mined ore which is processed into commercial silver or gold.

(years ended December 31)

|

2019 |

2020 |

2021 |

2022 | 2023 | |

|---|---|---|---|---|---|

|

Silver (ounces) |

9,890,125 |

10,494,726 |

9,243,664 | 9,741,935 |

9,731,752

|

|

Gold (ounces) |

56,625 |

48,491 |

46,088 | 48,216 |

60,896

|

|

Lead (tons) | 20,112 | 21,400 |

19,873 | 19,480 |

19,578

|

|

Zinc (tons) |

56,805 | 56,814 |

53,648 | 52,312 |

51,496

|

The 2023 exploration program successfully expanded mineralization at Greens Creek. Four underground drills focused on resource conversion and exploration that extended or confirmed mineralization of known resource areas. Drilling was focused in the 9a, 200 South, 5250, East, 9a, West, Upper Plate, Gallagher, and Gallagher Fault Block zones.

In 2024, of the $25.4 million planned for exploration and pre-development spend, 35% is planned for Greens Creek. Definition and exploration drilling from underground will focus on the 200S, 9A, Gallagher, SW, and Upper Plate zones. Surface exploration drilling will target near-mine areas at Upper Plate, East Ore Offset, and Gallagher West. Surface drilling is also planned for the recently acquired Mammoth Claims northwest of the mine. Surface mapping and surface and airborne geophysics are also planned for the Greens Creek property.

Greens Creek is exploring a number of areas on the 23-square-mile land package which could potentially lead to additional reserves and resources, further extending the mine life or even leading us to find another deposit like Greens Creek. There are over 30 miles of mine horizon where mineralization has been identified and projected along surface on our property.

The Greens Creek deposit is a polymetallic, stratiform, massive sulfide deposit. The host rock consists of predominantly marine sedimentary and mafic to ultramafic volcanic and plutonic rocks, which have been subjected to multiple periods of deformation. These deformational episodes have imposed multiple folding of the orebodies to create a complex geometry. Mineralization occurs discontinuously along the contact between a structural hanging wall of quartz mica carbonate phyllites, and a structural footwall of graphitic and calcareous argillite.

Ore lithologies fall into two broad groups: massive ores with over 50% sulfides and white ores with less than 50% sulfides. The massive ores are further subdivided as either base-metal or pyrite dominant. Massive ores vary greatly in precious-metal grade from uneconomic to bonanza Au (>.5 opt) and Ag (>100 opt). White ores are subdivided into three groups by the dominant gangue mineralogy: white carbonate, white siliceous, and white baritic ore. These ores tend to be base-metal poor and precious-metal rich. Important minerals include pyrite, sphalerite, galena, and tetrahedrite/tennanite.

Greens Creek is an underground mine that produces approximately 2,300 tons of ore per day. The primary mining methods are cut and fill and longhole stoping.

The Greens Creek unit has historically been powered completely by diesel generators located on site. However, since 2006, Hecla has purchased excess hydroelectric power from the local power company, Alaska Electric Light & Power Company (“AEL&P”). This project has reduced production costs at Greens Creek when hydroelectric power has been available. Since 2009, hydropower has provided 77% of Greens Creek’s energy needs.

There are three main phases to the mining process: development, production, and backfilling.

Development – the tunneling or accessing phase

Using plans from the geology and engineering departments, miners drive tunnels 15ft high by 15ft wide to access the various ore zones to be mined.

Production – the extraction phase

The method of extraction depends upon the geological nature of the orebody involved. Some of the smaller, more contorted orebodies are extracted using the same tunneling procedure as the development phase. In other more massive orebodies, larger scale extraction methods are used, sometimes producing voids of up to 150ft long, 25ft wide and 120ft deep.

Backfilling – the replacement phase

The voids created during the production phase are filled up with a combination of mill waste (tailings) and cement. This “backfilling” process stabilizes the production voids and allows extraction of the ore beside, above, and even below the backfilled area.

Hecla is the largest private-sector employer and taxpayer in Juneau, and we are proud to be a strong community partner. Our employees regularly volunteer in the community, and in 2022, we made a direct economic impact in local communities of more than $219 million, including approximately $76.8 million in wages, $29 million in taxes and fees, and $112 million in purchases from vendors.