Community

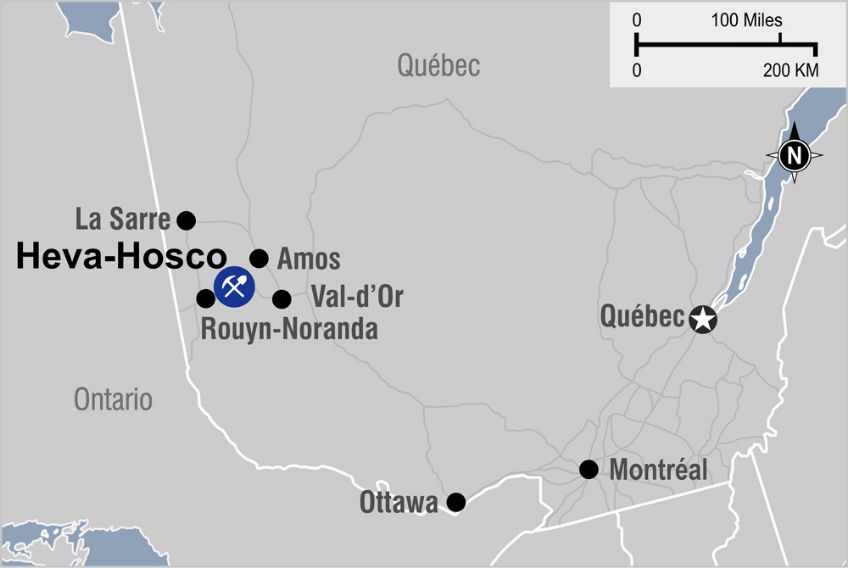

Every year, the Casa Berardi Mine team updates the list of stakeholders and communities that may have an interest in its activities. This update is then refined with the assistance of the Casa Berardi Mine Liaison Committee. If you would like to identify yourself as a stakeholder, please write to us at the e-mail address below. The process can be confidential if you wish. You can also subscribe to our e-mail list, which is used to share our Annual Reports with the community.

I would like to participate or be informed, write to us at: [email protected]

Procedure for communicating with us: At the Casa Berardi Mine, we sincerely believe that the community is a real ally in the continuous improvement of our practices. That's why we've set up accessible communication channels and a transparent, fair communication procedure to take your feedback into account.

Our Community Involvement

Firmly rooted in its community, Hecla Québec is particularly sensitive to the initiatives and efforts that vitalize the region and give it its unique color.

- Education

- Culture

- Health and community

- Sport and healthy living

- Environment and sustainable development

- Economic development

UQAT Foundation

Contributing to the advancement of teaching and research in Abitibi-Témiscamingue, recognizing excellence, community involvement and, above all, the perseverance of local students, are all incentives that led Hecla Québec to sign an historic agreement with the Fondation de l’Université du Québec en Abitibi-Témiscamingue in 2009.

- $1/ounce of gold produced at the Casa Berardi mine each year is donated to the Fondation de l’UQAT

- To date, $2,000,000 injected in the Hecla Québec Global Development Fund.

Each year, Hecla Québec also awards nearly $50,000 in university, college and professional scholarships.